Flood insurance is highly encouraged for Florida residents who live in high-risk flood zones, but how much is flood insurance in Florida? The average homeowner pays $937, with a cost range between $194 and $3,877.

Updated on Jul 12, 2023 8:56 PM EDT

We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

Florida is known for its breathtaking beaches and year-round warm temperatures, but many Florida residents are at risk of flooding caused by tropical storms or hurricanes. In fact, when Hurricane Ian hit the Sunshine State in September 2022, it caused between $41 billion and $70 billion in total damage. Of that damage, $8 billion to $18 billion was caused by flooding due to storm surge and inland flooding—and that only counts properties that were covered by a flood insurance policy. The Association of State Floodplain Managers estimates that uninsured flood loss for the affected area totaled between $10 billion and $17 billion. Knowing this, it’s clear that a flood insurance policy can help homeowners in Florida protect their home in the event it’s damaged from flooding—and, in some cases, flood insurance may be required. Along with learning how to prepare for a flood, getting flood insurance coverage can help Florida homeowners ride out a storm with less stress.

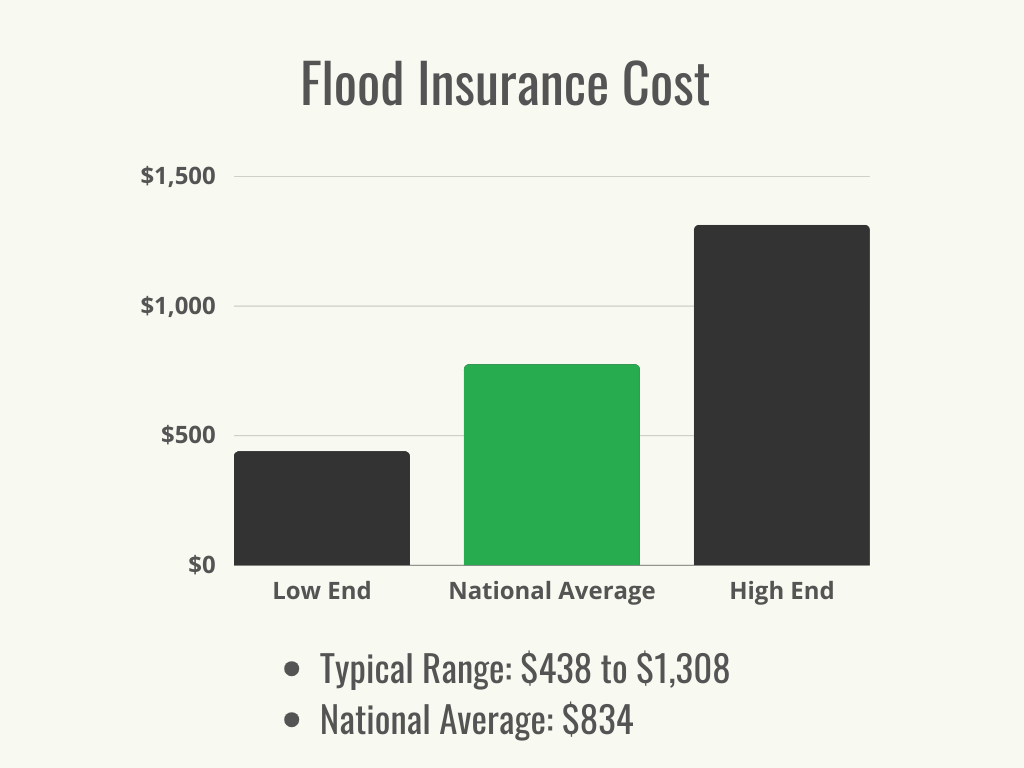

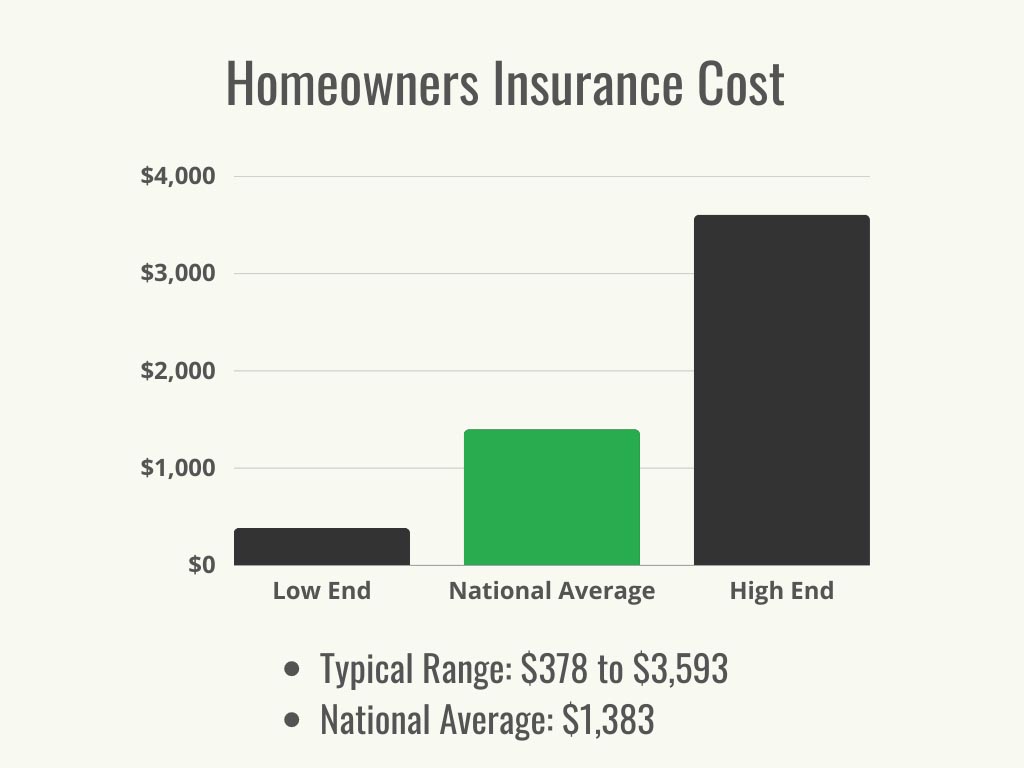

How much is flood insurance in Florida? Depending on the home’s location and other factors, Florida residents typically pay between $194 and $3,877 per year for flood insurance, with policies costing an average of $937 per year. The exact price of flood insurance can vary based on the property’s flood risk, the structure of the building, and the type and amount of coverage the policyholder chooses. This guide will explore the factors that affect the cost of flood insurance in Florida, as well as the types of coverage provided, the ways homeowners can save on their flood insurance premiums, and the questions customers will want to ask when considering the best flood insurance companies in Florida.

There are several factors that insurance providers take into account when calculating the average flood insurance cost in Florida. These include the home’s elevation and flood zone, the geographic area of Florida in which the home is located, the characteristics of the building, the type and amount of coverage the policyholder needs, and the deductible amount. Additionally, costs can vary depending on whether a customer opts for coverage through the National Flood Insurance Program (NFIP) or a private insurance company—and if a customer chooses a private insurer, the costs can also differ from company to company.

The Federal Emergency Management Agency (FEMA) estimates that 27 percent of Florida housing units are at high risk of flooding. Florida residents can see the flood risk in their area by checking the FEMA Risk Rating 2.0. This methodology takes several factors into account, including weather patterns, land development, erosion, flood frequency, multiple flood types (such as river overflow, storm surge, and heavy rainfall), and distance from a water source. From there, FEMA creates community flood maps that show the flood risk for that particular area, and insurance providers use that information to determine policy costs. New homeowners who are taking out a mortgage on a home in a high-risk flood zone will likely be required by their lender to purchase flood insurance coverage. In addition, those who have a homeowners insurance policy through Citizens Insurance and live in a special flood hazard area (SFHA) will be required to also carry flood insurance by 2027. An SFHA is a flood zone with an A or V designation; the table below explains these zones, their risk levels, and their average flood insurance costs.

| Flood Zone | Risk | Average Annual Flood Insurance Cost |

| A | High | $674 |

| AE | High | $757 |

| AH | High | $439 |

| AO | High | $343 |

| D | Undetermined | $1,273 |

| V | High | $3,516 |

| VE | High | $1,044 |

| X | Minimal to moderate | $506 |

Risk Rating 2.0 was introduced to better represent the flood risk in different areas, making it easier to determine realistic flood insurance rates for customers. For some Florida residents, this could mean a decreased flood insurance premium—but others will see their premiums increase in the coming years. FEMA is limiting premium increases to 18 percent per year, which means customers in high-risk areas may have several years of premium increases. The table below gives some examples of rate increases in different areas within Florida.

| County | Average Rate Increase |

| Florida state average | 131 percent |

| Brevard | 254 percent |

| Lake | 29 percent |

| Manatee | 99 percent |

| Miami-Dade | 94 percent |

| Nassau | 147 percent |

| Polk | 9 percent |

| Sarasota | 114 percent |

The elevation of a home can have an impact on the cost of flood insurance in Florida. Homeowners can obtain a FEMA Elevation Certificate that shows their property’s elevation compared to the base flood elevation on a flood map. Homes that are built at a lower elevation will likely have higher flood insurance rates than those built at a higher elevation, as a home at the base elevation has a 1 percent chance of flooding each year, whether due to a hurricane or a flash flood. If the homeowner doesn’t have an existing elevation certificate, they can either check with the floodplain manager at their local municipal office or have a professional land survey completed and a surveyor issue a new certificate.

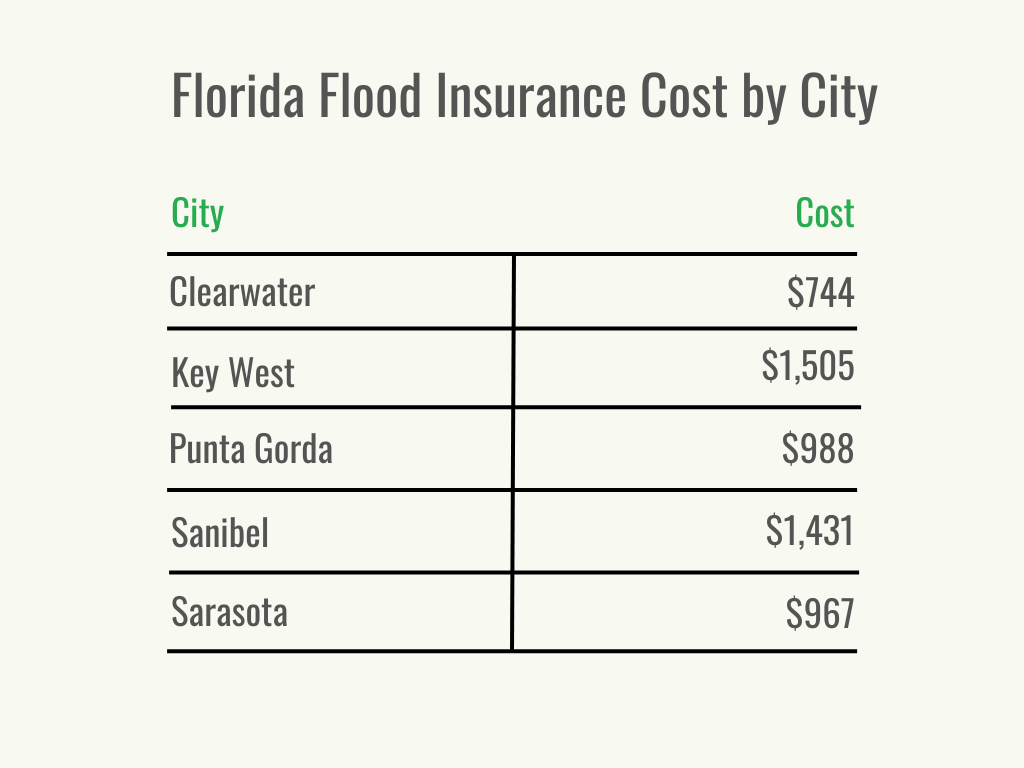

The city in which the home is located can also have an impact on Florida flood insurance costs. In general, a home located in a city that borders a river, lake, or the coast is at a higher risk of flooding, which means higher flood insurance rates. What follows are some examples of Florida cities and their average annual flood insurance costs.

The characteristics of a building can also influence the cost of flood insurance in Florida. For example, a home built using masonry or concrete instead of a wood frame is less likely to sustain severe damage from flooding. The cost to build a hurricane-proof modular home is relatively low, and a home designed to withstand a hurricane will likely have lower flood insurance premiums. Similarly, a homeowner who invests in hurricane shutters may pay less for flood insurance. The type of foundation upon which the home is built can also affect flood insurance rates; a home that rests on a slab is at a higher flood risk than one that’s raised off the ground using pilings. Additionally, the presence of HVAC units and water heaters above the first floor lessens the risk of those systems being destroyed by a flood, which can translate to lower premiums. Finally, a building with more than one floor will likely cost less to insure for flood damage because the upper floors are more likely to remain unscathed during a flood, while a single-floor property can be completely destroyed.

The best home builders in Florida are familiar with the state’s unique building needs, but those planning on building a new home in the state will want to ask questions of their builder to ensure their home will be built to withstand the type of weather they can expect in their area.

Homeowners can purchase flood insurance policies that cover the structure of their home, the home’s contents, or both. Choosing both coverage types will increase the total cost of flood insurance, but the homeowner will be more fully covered should their home sustain damage from a flooding event. Renters can also opt for a flood insurance policy that offers contents coverage, while their landlord’s policy will cover damage to the building itself.

The amount of coverage will also affect the price of flood insurance for Florida residents. Homeowners and renters who choose higher levels of coverage will typically have higher premiums, while those who decrease their coverage amount will pay a lower premium.

When a policyholder makes a claim on their flood insurance policy, the payout is reduced by the amount of the policyholder’s deductible. For example, a homeowner whose home sustains $30,000 in flood damage and has a $2,000 deductible will receive a $28,000 payout from their insurance provider upon claim approval. A policyholder who chooses a higher deductible will typically have a lower premium, and vice versa.

When it comes to flood insurance policies in Florida, customers can choose between taking out a policy through the National Flood Insurance Program (NFIP) or through a private insurer (or a combination of both). There are numerous insurance companies that can write policies in Florida under the NFIP, including Allstate, Assurant, Farmers, Liberty Mutual, and USAA. NFIP policies have limits on building and contents coverage and do not offer additional types of coverage such as loss of use coverage or debris removal. However, customers who are looking for less comprehensive coverage may find better premiums through the NFIP than through private insurers (though that may not necessarily be true in all cases).

If a customer chooses coverage from a private insurer, the cost can vary depending on which insurance company they choose. Customers are advised to get several flood insurance quotes in Florida from different companies to see which one best fits both their budget and their coverage requirements.

In addition to the aforementioned cost factors, there are several potential considerations that could have an impact on how much flood insurance costs in Florida. These include whether a customer chooses replacement cost coverage or actual cash value coverage, and whether the property is a customer’s primary residence or a part-time or vacation home.

When it comes to insurance coverage, customers often have the choice between actual cash value and replacement cost coverage. In the event of a covered loss, an actual cash value policy will pay the policyholder the depreciated value of the item, whereas replacement cost coverage will pay the cost to replace the item with a similar item at today’s prices. For example, if a policyholder had a replacement cost policy and made an insurance claim involving a 5-year-old television, the insurance company would pay to replace the TV at today’s prices (less the deductible). If a policyholder had an actual cash value policy, however, the insurance company would only cover the depreciated value of the TV, which could end up being much less than it would cost to replace the TV.

When it comes to flood insurance, the NFIP generally offers replacement cost dwelling coverage (with some exceptions; damage to wall-to-wall carpeting is typically paid on an actual cash value basis) and actual cash value personal property coverage. Customers who choose to go with a private insurer may have the option to choose between actual cash value and replacement cost coverage for their personal property flood insurance coverage. In general, replacement cost coverage is more expensive than actual cash value coverage since the insurer will likely pay out higher amounts if the customer submits a claim.

Another potential cost factor when it comes to determining estimated flood insurance cost in Florida is whether the home is a primary or part-time residence. In general, homeowners are likely to pay lower flood insurance premiums if they’re insuring their primary residence than if they’re insuring a home in which they reside for half a year or less. In addition, the NFIP adds a $250 surcharge per year for homes that are not the policyholder’s primary residence; that surcharge is just $25 per year if the home is the policyholder’s primary residence.

What does flood insurance cover? There are several types of coverage that Florida residents can choose when it comes to flood insurance. These include building property coverage, personal property coverage, loss of use coverage, loss avoidance coverage, and debris removal coverage.

Building property coverage is one of the most common types of coverage from Florida flood insurance providers. This coverage will help pay to repair or rebuild the home’s structure following a damaging flood. The NFIP has a building property coverage limit of $250,000 for residential properties ($500,000 for commercial properties), so owners whose property value exceeds that amount will likely want to consider private flood insurance instead.

Another common type of flood insurance coverage is for the policyholder’s personal property. This coverage will help pay to repair or replace personal belongings that are damaged in a flood, including furniture, clothing, electronics, and more. The NFIP has a maximum coverage limit of $100,000 for personal property, whereas private insurers tend to have much higher coverage limits.

Private insurers may include loss of use coverage in their flood insurance policies. This type of coverage can help pay for additional living expenses if the policyholder is required to relocate while their home is repaired or rebuilt after a flooding event. This coverage can help pay for hotels or short-term rentals, restaurant meals out if the policyholder doesn’t have access to a kitchen, and travel expenses if the policyholder must travel farther than usual to work. NFIP policies do not include loss of use coverage.

Certain expenses may be covered by private flood insurance providers if they help the homeowner mitigate the potential damage a flood could do to their home. Loss avoidance coverage can help pay for items such as water pumps, plastic sheeting and lumber, sandbags, and moving and storage expenses, among others. If the homeowner’s flood insurance policy offers this coverage, they will likely be required to save receipts and use them to submit claims for reimbursement up to the policy limits.

Debris removal may be covered by NFIP and private flood insurance policies. This coverage can be important for Florida homeowners following a tropical storm or hurricane, since there can be a great amount of debris on their property that they’ll need to get rid of. Debris removal coverage can help a homeowner with this expense, whether the work is done by a professional or by the homeowner.

Florida residents may be wondering, “Do I need flood insurance?” While Florida flood insurance is not always required by law, there are several strong arguments that may encourage residents to consider getting a flood insurance policy. These include state requirements, mortgage lender’s requirements, the flood risk in the area where the home is located, and the home’s proximity to water.

Homeowners with a government-backed mortgage who live in high-risk flood areas are required by federal law to carry a valid flood insurance policy. Additionally, homeowners who have received disaster assistance in the past from FEMA must maintain a flood insurance policy to be eligible for future assistance.

In Florida, as of April 1, 2023, homeowners wanting to take out a new homeowners insurance policy with the not-for-profit Citizens Property Insurance Corporation are required to purchase flood insurance if they live in a FEMA-designated special flood hazard area. Those who already have a homeowners insurance policy with Citizens are required to have flood insurance in order to renew their policy after July 1, 2023. By January 1, 2027, all Citizens policyholders with a homeowners insurance policy that includes wind coverage will be required to have flood insurance. This is part of the state’s plan to stabilize its home insurance market, which has seen rising premiums in recent years, leaving many property owners unable to afford adequate coverage. The table below shows the dates homeowners are required to have coverage by, based on their homeowners insurance dwelling coverage amount.

| Date | Customers Required to Carry Flood Insurance |

| July 1, 2023 | Citizens policyholders living in a special flood hazard area (SFHA) |

| January 1, 2024 | Citizens policyholders with a property valued at $600,000 and up |

| January 1, 2025 | Citizens policyholders with a property valued at $500,000 and up |

| January 1, 2026 | Citizens policyholders with a property valued at $400,000 and up |

| January 1, 2027 | All citizens policyholders |

Mortgage lenders may require borrowers to have a flood insurance policy if the property they’re financing is considered to be at a high risk of flooding. The exact requirements will likely vary among lenders, so it’s important for home buyers to ask their mortgage lender whether they’ll be required to purchase flood insurance so they can fit the additional expense into their home-buying budget. In general, homes financed by federally backed loans such as those from the Federal Housing Administration (FHA), United States Department of Agriculture (USDA), or Department of Veterans Affairs (VA) will be required to have flood insurance if the home is located in a FEMA-designated special flood hazard area (SFHA).

FEMA uses a methodology called Risk Rating 2.0 to determine the flood risk in a given area. This methodology takes several factors into account when determining flood risk, including the type of foundation the home has, the elevation of the home, and the home’s proximity to water. If a home is determined to be at a high risk of flood damage by Risk Rating 2.0, the homeowner is strongly advised to take out a flood insurance policy to help cover any potential damage that the home sustains.

Florida homes that are located close to a waterfront such as a beach or lake are strongly encouraged to take out a flood insurance policy—even if their mortgage lender doesn’t require it. This is because the home’s location makes it susceptible to damage from floods, and if the homeowner doesn’t have flood insurance coverage they may be unable to pay to repair the damage or rebuild the home.

Flood insurance in Florida can vary in cost depending on where the home is located, in addition to several other factors. While a home in a high-risk flood zone is likely to have a higher flood insurance cost than one in a low-risk zone, there are a few things customers can do to reduce the overall cost of flood insurance.

When considering flood insurance providers, customers will want to ask a series of questions to determine which provider best meets their coverage needs while ensuring the policy fits within their budget. Asking the following questions can help potential policyholders find the best flood insurance in Florida for them.

Flood insurance is a complicated topic, especially for homeowners and renters who live in high-risk zones in Florida. The following frequently asked questions and their answers can help customers better understand how flood insurance works so they can choose a policy that works for them from one of the best flood insurance companies.

Flood insurance is not required for all Florida residents—but there may be some cases where it is required. For example, customers with homeowners insurance policies through Citizens Insurance will be required to take out a flood insurance policy by 2027. While flood insurance is not required by law, it’s still a good option for most Florida residents to consider. Residents who live in a high-risk flood zone may be required by their lender to carry flood insurance. Others who own their home outright or whose risk is lower are still advised to take out a flood insurance policy to help protect their investment.

Flood zones in Florida are determined by the Federal Emergency Management Agency (FEMA) and given a rating to show the likelihood that a home in a certain area will flood. The ratings start with a letter, with A and V zones considered to be the highest risk. Almost three-quarters of Florida homes are located within flood zones X, C, and B, which are considered to have a moderate risk of flooding; however, more than 20 percent of NFIP flood claims come from low- to moderate-risk areas, according to the National Association of Insurance Commissioners.

Florida homeowners can purchase flood insurance at any time; however, many flood insurance policies have a 30-day waiting period, meaning the policyholder cannot make a claim within that time frame. This is to prevent homeowners from taking out a flood insurance policy only when their home is in the direct line of a tropical storm or hurricane. Rather, it’s recommended that homeowners in Florida take out a flood insurance policy upon purchasing a home to make sure they’re covered if their home is damaged by flooding.

The average flood insurance cost in Florida is $937 per year, though the typical range falls between $194 and $3,877. The exact cost for each policyholder will depend on the home’s proximity to water, the flood risk in the area where the home is located, the type of coverage selected, the deductible, and more. Homeowners can find the cheapest flood insurance in Florida that offers the coverage they need by contacting several insurance providers for quotes.

Flood insurance generally covers flood damage to the structure of the home as well as the resident’s personal property. Some policies may also offer coverage for additional living expenses if the homeowner is required to live elsewhere while repairs are made, or for debris removal and flood mitigation or loss avoidance. Homeowners are encouraged to check with their chosen flood insurance provider to determine exactly what is covered by their flood insurance policy.

Like home insurance, flood insurance policies are valid for 1 year. Customers will need to renew their policy each year in order to continue coverage. If coverage lapses, the customer will still be covered by the policy for 30 days after it expires, provided that the full renewal premium is paid by the end of the 30-day grace period.

Catherine Hiles is a senior editor for the Performance team at BobVila.com. She brings a decade of experience writing, editing, and publishing in a variety of different industries, from home and automotive to finance and travel.

Learn more about BobVila.com Editorial Standards

Subscribe to our newsletters for the best tips, tricks, and ideas to transform your home and yard.

By signing up you agree to our Terms of Service and Privacy Policy.

Subscribe to our newsletters for the best tips, tricks, and ideas to transform your home and yard.

By signing up you agree to our Terms of Service and Privacy Policy.

Articles may contain affiliate links which enable us to share in the revenue of any purchases made. Registration on or use of this site constitutes acceptance of our Terms of Service.

© 2024 Recurrent. All rights reserved.